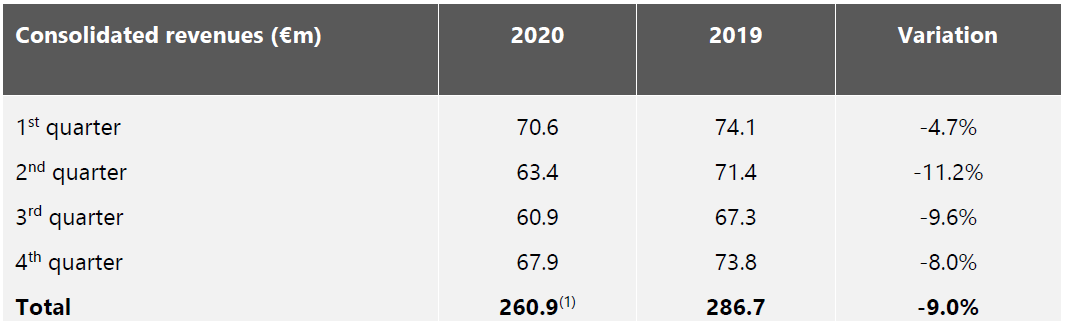

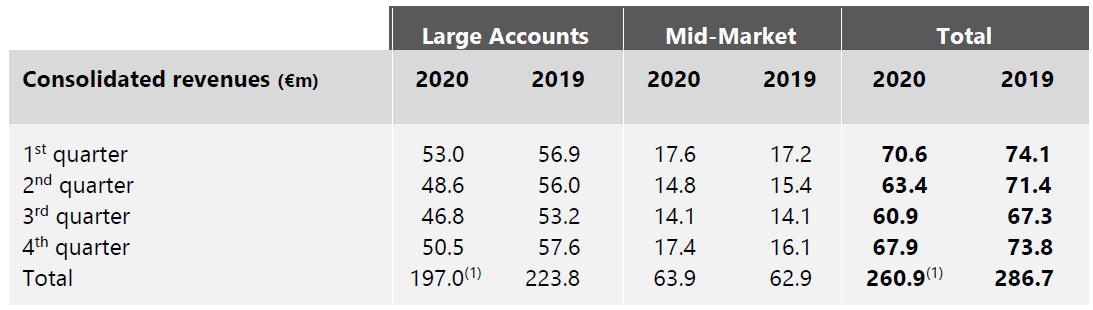

Levallois, 11 February 2021 – the Keyrus Group recorded revenues of 67.9 million euros in the fourth quarter of 2020, down by 8.0% (-9.2% at constant scope and exchange rates) as compared with the fourth quarter of 2019. For 2020 as a whole, the decrease in revenues was 9.0% (-9.8% at constant scope and exchange rates).

Large Account activities decreased by 12.3% compared to the fourth quarter of 2019 (-13.8% at constant scope and exchange rates). Mid-Market activities grew by 7.3% (+7.1% at constant scope and exchange rates).

The decline in the Large Account segment remained essentially concentrated in Europe, and notably in France, where demand continued to be severely affected by the health crisis. This crisis has had less of an impact on the U.S. market, where growth remained strong.

Keyrus undertook two strategic investments during the fourth quarter: in France, it acquired, in November 2020, a majority holding in the Xiomega Consulting company, a specialist in providing consulting services to IT departments and managing digital transformation projects; in the United States, Keyrus acquired, in December 2020, a majority holding in RunAsCloud, a company specialized in Cloud-strategy consulting. These two acquisitions contributed €1.0m to fourth-quarter revenues.

Against the background of a market in which, on the one hand, there continues to be uncertainty regarding the recovery of investment cycles, notably in markets outside Asia and the United States, but in which, on the other hand, companies’ digital and data transformation issues remain a priority, Keyrus continues to have confidence both in its strategy and its ability to maintain its leading position as an international-level specialist player in Data, Digital, and Move-to-Cloud business lines.

Overall, 2020 witnessed a decrease in revenues from Large Account activities of 12.0% (12.8% at constant scope and exchange rates) and the acceleration of significant transformations at various levels of the organization so as to prepare for the post-Covid recovery.

Across all of the geographical areas in which it operates, Keyrus continues to apply precautionary measures to address health risks, notably by limiting business travel to that which is strictly necessary, and promoting homeworking.

The Mid-Market segment, the activities of which are carried on by our Absys Cyborg subsidiary, saw its revenues increase significantly in the final quarter, thanks mainly to a healthy recovery in service-delivery activities, with subscription sales having also remained on an upward trend. This upturn in service activity had been announced in the publication of revenues for the third quarter, and it enabled Absys Cyborg to end the financial year with an annual increase of 1.5% (1.1% at constant scope and exchange rates), with the proportion of recurring contractual business having increased to the point where it accounted for nearly 50% of annual revenues.

The Group nevertheless remains highly alert to the risk that the current crisis could bring of small and medium-sized companies failing during the current financial year.

Measures & Impact relating to the Covid-19 crisis

On the financial front, in July 2020 the Group obtained the agreement of its partners to the granting of a State-backed loan of €10m, which, when added to available cash, is bolstering Keyrus’s financial ability to face up to the effects of this unprecedented crisis. On an operating level, the Group and its subsidiaries have set up arrangements to monitor cashflow and update forecasts on a weekly basis.

As at 31 December 2020, cashflow forecasts did not reveal any financing difficulties or non-compliance with covenants.

Keyrus will publish its 2020 annual results on 22 April 2021, after market close.

Breakdown of revenues by operational sector

(1) B&C Technologies, which was acquired by the Keyrus Group in March 2020, had, up until 30 September 2020, been treated as fully integrated. On 31 December 2020, and with the approval of its auditors, the Keyrus Group reconsidered its method for consolidating B&C Technologies and decided to adopt the equity method. As a consequence, €1.9m of the revenues in the first three quarters are, therefore, not taken into account in the total revenues for 2020.

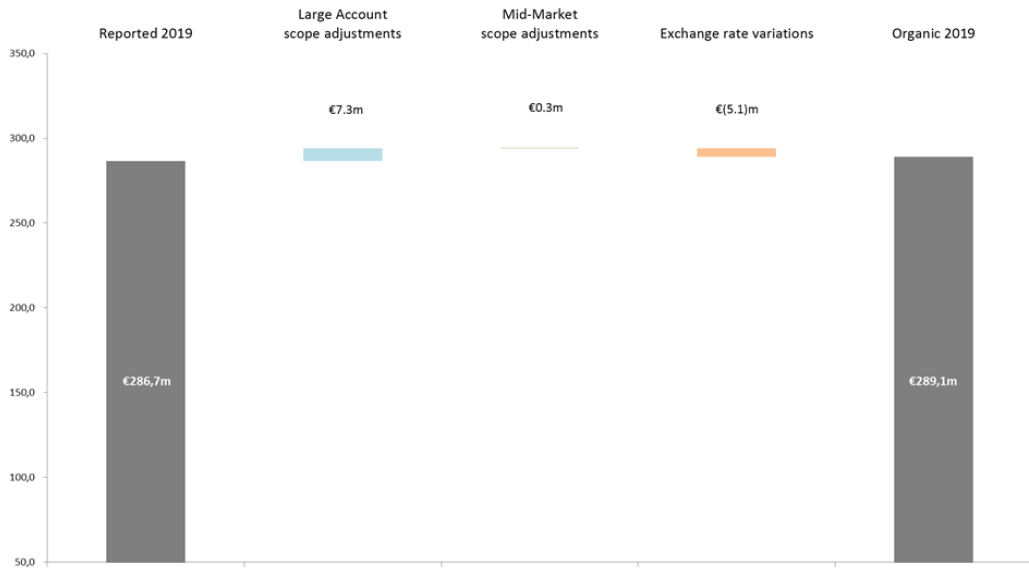

* DEFINITION OF THE NOTION OF ORGANIC GROWTH IN REVENUES

The notion of organic growth in revenues involves presenting the revenues of the preceding year (N-1, in this case, the 2019 financial year) restated in such a way as to apply the exchange rates and scope of consolidation of the current year (N, in this case, the 2020 financial year). The Group then calculates a figure for organic N-1 revenues by:

using the exchange rates of year N to calculate the reported revenues of companies outside the Eurozone in year N-1 ;

adding to the reported revenues for year N-1 the N-1 revenues of companies that came within the scope of consolidation in year N ;

deducting from the reported revenues for year N-1 the N-1 revenues of companies that went out of the scope of consolidation in year N.

In 2020, the adjustments to go from reported 2019 revenues to organic 2019 revenues look as follows: