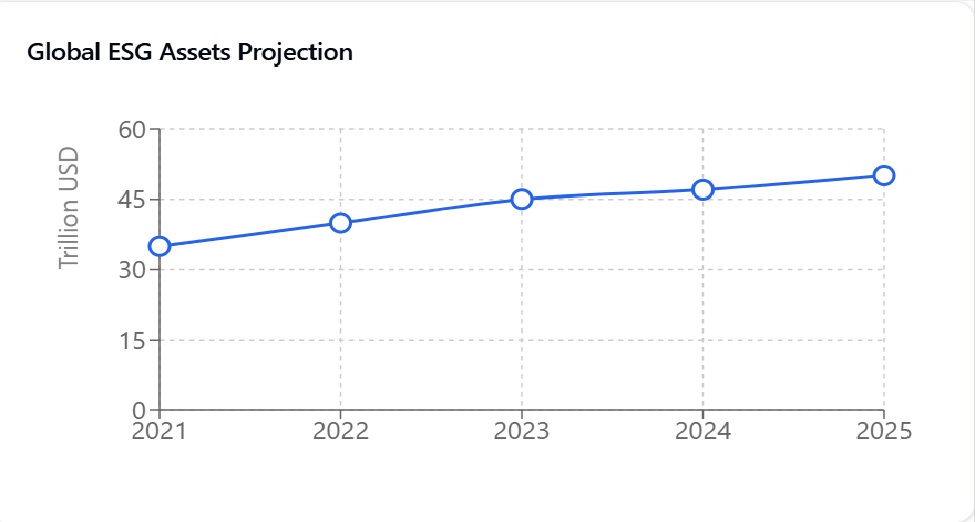

As global markets navigate unprecedented change, Environmental, Social, and Governance (ESG) reporting has transformed from a voluntary initiative into a strategic imperative for asset managers. What was once viewed as a 'nice-to-have' is now driving investment decisions worth trillions. According to recent Bloomberg Intelligence data, global ESG assets are projected to exceed $50 trillion by 2025, with the UK leading European markets in sustainable investing growth. This seismic shift presents both an opportunity and a challenge for organisations: how to effectively capture, report, and leverage ESG data to build investor trust and attract capital.

The Trust Premium: ESG in UK and Global Markets

The correlation between trustworthy environmental social governance reporting and investment decisions has never been stronger. PwC's 2023 Global Investor Survey reveals a startling trust gap: 94% of investors suspect greenwashing in corporate sustainability reports, highlighting the critical need for verified ESG data. Investment strategies remain firmly anchored in sustainability, with 75% of investors ranking a company's sustainability risk management as a key decision driver, further adds the PwC findings. This "trust premium" translates directly to market value – companies with robust ESG frameworks consistently command higher valuations and attract more stable, long-term investors.

Building Credibility Through Corporate Sustainability

For C-level executives, the message is clear: excellence in ESG data management is no longer optional. Findings of a research by a government run organisation indicates that companies with strong ESG performance experience lower stock price volatility compared to those with weaker ESG performance. This stability stems from increased transparency and stakeholder trust. Moreover, with regulations like SFDR, EU Taxonomy, and CSRD demanding accuracy, standardisation and transparency organisations must prioritise robust ESG data management systems and reporting frameworks to maintain market confidence and ensure regulatory compliance. The key lies in implementing comprehensive ESG compliance frameworks that ensure:

Consistent data collection across all operational units

Regular validation and verification of ESG metrics

Real-time monitoring and reporting capabilities

Alignment with evolving regulatory standards

The Hidden Costs of Poor ESG Data Management

The repercussions of inadequate ESG data governance extend far beyond mere regulatory non-compliance. Poor Environmental, Social, and Governance (ESG) data management can lead to significant hidden costs for UK companies, impacting various aspects of their operations and reputation. Key areas affected include:

Financial Penalties and Regulatory Risks

Inaccurate ESG reporting can result in substantial fines and increased regulatory scrutiny. For instance, Drax Group faced a £25 million penalty from Ofgem due to inadequate data governance related to their biomass sourcing. This case underscores the financial risks associated with poor ESG data management.

Reputational Damage

Mismanagement of ESG data can erode stakeholder trust. A report by Dawleys highlights that poor data management can lead to reputational harm, as stakeholders may question the integrity and reliability of a company's ESG commitments.

Increased Operational Costs

Handling poor-quality data often requires additional resources to rectify errors, leading to inefficiencies. The UK Government Data Quality Hub notes that organisations may spend between 10-30% of their revenue addressing data quality issues, which can be mitigated through effective ESG data management.

Compliance Challenges

With evolving ESG regulations, companies may struggle to adhere to new standards, leading to potential legal issues and associated costs. A blog by Thomson Reuters debates the hidden costs and risks associated with poor statutory reporting and emphasises the need for integrating ESG factors into reporting processes to ensure compliance and avoid penalties.

Automation: The Cornerstone of Sustainable Investing

As regulatory requirements continue to evolve, manual ESG reporting processes are becoming increasingly unsustainable. The EU's Corporate Sustainability Reporting Directive (CSRD) and similar regulations worldwide demand a level of accuracy and granularity that only automated solutions can reliably deliver. Organisations leveraging automated ESG reporting platforms report:

Significant reduction in data collection and validation time

Improved accuracy in reporting errors

Enhanced ability to respond to regulatory changes

Improved stakeholder engagement through more consistent reporting

Building a Future-Proof ESG Framework

The path to trustworthy ESG reporting begins with recognising that this is not just a compliance exercise but a strategic imperative. Forward-thinking organisations are investing in scalable platforms that can:

Integrate seamlessly with existing data systems

Adapt quickly to new regulatory requirements

Provide real-time insights for decision-makers

Generate consistent, audit-ready reports

Keyrus: Your Reliable Partner in ESG Excellence

In the intricate landscape of ESG reporting, success hinges on choosing a strategic partner with proven expertise and innovative solutions. Keyrus's comprehensive ESG reporting solution offers a transformative approach to corporate sustainability and ESG compliance. Our platform leverages cutting-edge automation and data management capabilities to help organisations:

Accelerate sustainable investment strategies implementation by 3x

Ensure consistent, high-quality reporting that builds stakeholder trust

Adapt seamlessly to evolving regulations while reducing manual workload

Generate transparent, accurate reports that attract and retain investors

Provide support to compliance and risks teams to manage sustainability associated risks

Read this exclusive case study and learn how Keyrus helped a major US banking institution to incorporate ESG and Climate Risk as part of its Investment Risk exposure analysis offering. The challenge was to develop analysis and reports that would meet ESG compliance monitoring obligations faster than an in-house 12-month estimate.

The Path Forward

As we move towards a future where ESG considerations increasingly drive investment decisions, organisations must ask themselves: Are we building the trust necessary to attract and retain investors? The answer lies in how effectively they manage and report their ESG data. By implementing robust, automated ESG reporting solutions like those offered by Keyrus, organisations can not only meet current regulatory requirements but position themselves as leaders in the sustainable investment landscape. The result? Stronger stakeholder relationships, enhanced market reputation, and a competitive edge in attracting investment capital.

The time to act is now. As regulatory requirements tighten and investor scrutiny intensifies, organisations that delay implementing comprehensive ESG reporting solutions risk falling behind. Building trust through data excellence isn't just good practice – it's essential for survival in today's ESG-conscious market. For more information, contact our team of experts now.

Sources used in the article: