Today’s dynamic financial landscape has become more complex due to the ever-evolving regulations which has made compliance management a time-consuming process. Compliance isn't just about ticking boxes—it's about transforming how your finance team operates. As regulations like IFRS 17, Basel IV, and ESG reporting reshape the financial sector, finance leaders face unprecedented challenges in maintaining both compliance and operational efficiency.

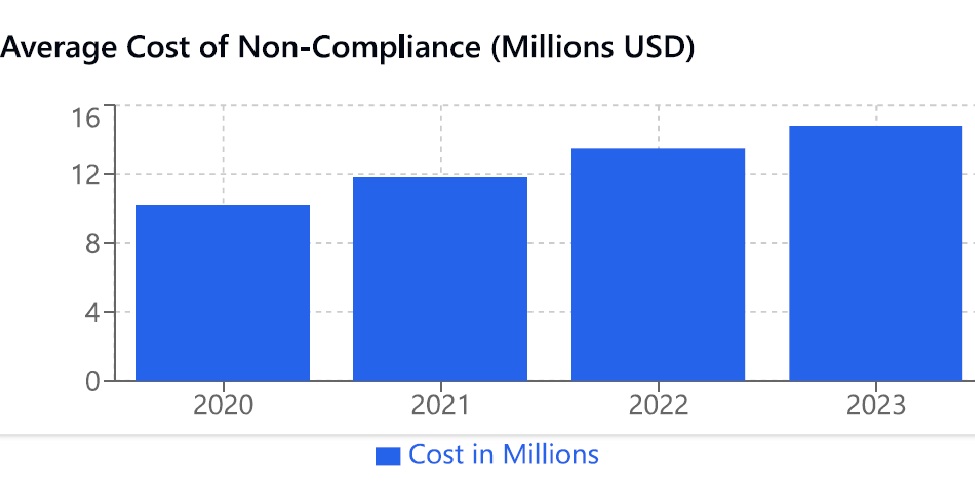

The Rising Cost of Compliance

The numbers tell a compelling story about the growing complexity of financial compliance. According to a 2023 report by the Thomson Reuters on the Cost of Compliance, more than half of financial institutions now invest over $10 million annually in regulatory compliance. For retail and corporate banks, this investment reflects a dramatic 60% increase in compliance costs over the last eight years, says another report by a global professional services firm. Perhaps it’s even more concerning to learn that the finance teams are constantly caught in a cycle of excessive manual data preparation and validation.

Understanding Today's Compliance Landscape

The modern compliance landscape presents a complex web of challenges across multiple domains. In IFRS reporting, organisations grapple with the intricate task of consolidating financial data across subsidiaries while maintaining consistent reporting standards across different jurisdictions. The tax compliance sphere adds another layer of complexity, with teams navigating the maze of transfer pricing documentation and evolving tax regulations across borders. Meanwhile, the emergence of ESG reporting has introduced entirely new challenges, demanding sophisticated approaches to collecting and validating environmental impact data while meeting diverse stakeholder requirements.

Transforming Compliance Through Technology

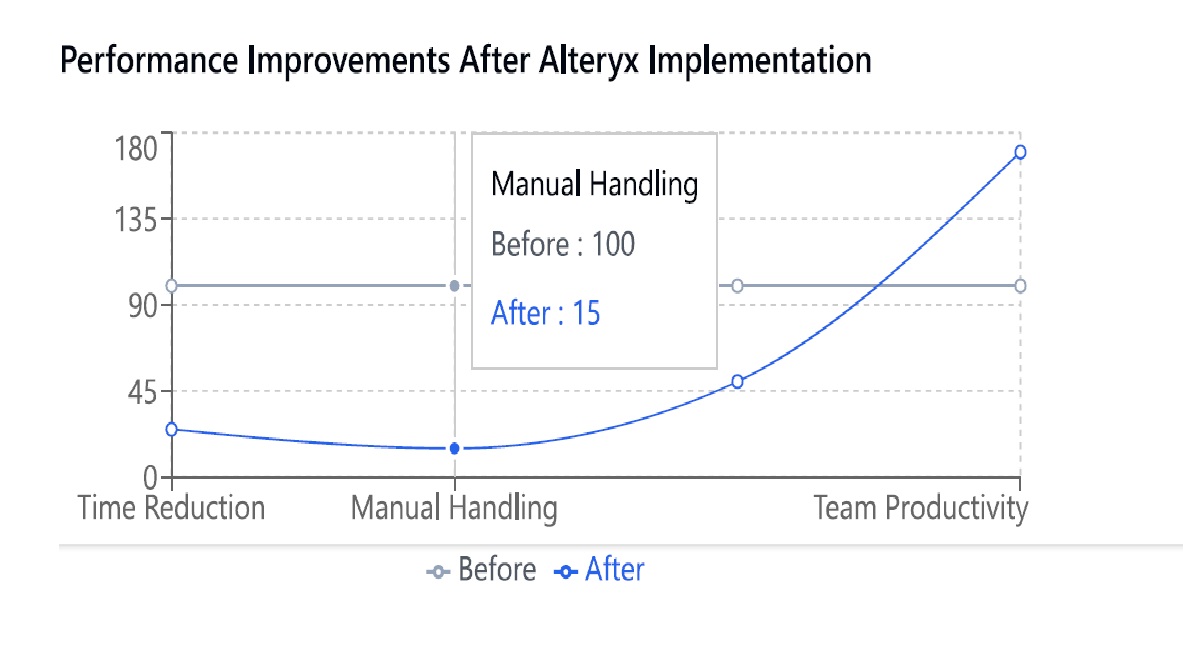

Enter Alteryx, a trusted analytics platform that is revolutionising how finance teams approach compliance. The platform's sophisticated data integration capabilities connect seamlessly with over 80 data sources, from traditional ERP systems to modern cloud services. This integration is complemented by data cleansing and standardisation processes, ensuring data quality and consistency across all compliance processes.

Consider the success story of a leading global investment bank that embraced this technological transformation. By implementing Alteryx, they achieved what once seemed impossible: After just five weeks, the organisation completed 14 use cases equalling the work of 1.5 full-time employees per year and an ROI of 275%. Ten workbook processes were replaced, and because of training and support, the organisation now has five subject matter experts to continue their work.

Building Your Compliance Framework of Tomorrow

The path to modernising compliance processes begins with a strategic approach to data integration. Modern finance teams must handle data from a vast array of sources, making automated integration not just beneficial but essential. Alteryx's automation analytics tools excel in this arena, eliminating manual data consolidation while maintaining impeccable data integrity—a crucial factor for accurate compliance reporting.

Quality control takes on new dimensions with validation rules and consistency checks. The platform's comprehensive approach includes user built automated data quality scoring, and real-time error detection, all supported by detailed audit trails that ensure transparency and accountability.

The Implementation Journey

Successful implementation of automated compliance solutions follows a clear pathway. Begin with a thorough audit of your current processes, identifying bottlenecks and opportunities for automation. Start with a focused pilot project—perhaps quarterly regulatory reporting—to demonstrate value and build confidence within your team.

Professional development plays a crucial role in this transformation. Alteryx offers comprehensive training resources, from online learning platforms to certification programs, supported by an active user community and regular educational events. This investment in training ensures your team can fully leverage the platform's capabilities while maintaining compliance standards.

Looking Ahead

As regulatory requirements continue to evolve, the ability to adapt quickly while maintaining accuracy becomes increasingly crucial. Through Alteryx’s automation analytics, finance teams can respond swiftly to regulatory changes, significantly reduce compliance-related risks, and redirect valuable resources toward strategic initiatives. The platform enables consistent reporting standards across organisations while providing the flexibility needed to adapt to future regulatory changes.�

Your Next Steps

The journey to automated compliance doesn't have to be overwhelming. Working with experienced partners like Keyrus, who understand both the technical and regulatory aspects of financial compliance, can smooth the transition and accelerate your success. As the regulatory landscape continues to evolve, the question isn't whether to modernise your compliance processes, but when and how to begin.

So, are you ready to transform your approach to regulatory compliance? Discover how Keyrus and Alteryx can help your finance team build a more efficient, accurate, and future-ready compliance framework.

Contact Keyrus today and join our Free 2-hour Alteryx workshop to learn more about our financial compliance automation solutions.

Register Now for Alteryx Roundtable Dinner

Keyrus and Alteryx would like to invite you to a peer-to-peer Office of Finance Transformation Roundtable Dinner on Thursday, 27th March at Hawksmoor Wood Wharf, in London. After the success of our last two Roundtable Dinners, we’re excited to bring finance leaders together once again this March. This time, we’ll continue building a strong community while exploring the role of AI, transformation, and the challenges that will shape 2025.

Click here to reserve your Free space Now! (Please note, this event is only applicable to clients from the Investment Banking/Finance sector)

Sources used in the article: