Background

Documents prepared by research analysts and strategists play important roles at investment banks, especially when the reports contain actionable recommendations. Finance research reports are distributed through oversubscribed distribution lists, which leads to low readership rates, typically around 2 or 3 percent. The sheer amount of material produced by strategists and analysts at investment banks also makes it difficult to identify existing or new subscribers of interest, who may not otherwise be notified or aware that the information exists.

Solution

At a large American investment bank, Keyrus implemented a machine learning algorithm to identify subscribers of interest for research produced by the Fixed Income Department. The algorithm ensured that the actionable intelligence contained in the reports reached the necessary target audience but not the subscribers less likely to read it.

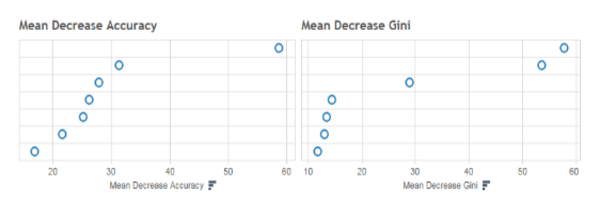

The Keyrus team engineered the necessary feature set from the report, contact, trading, distribution, and other data. The algorithm examined the universe of reports that had high readership rates and identified the most influential factors from all of the input variables.

The resulting model can predict whether a recipient will read a report or not with over 75% accuracy. Further, the algorithm is highly portable and can be incorporated into other research divisions at the bank to be used as a recommendation engine that constructs target audience lists for any new research report.

Outcome

Readership rates increased dramatically and overall readership (the total amount of times reports are read) is slowly increasing as well. The model is better able to identify who would most likely be interested recipients for the research produced by the Fixed Income Department and reduce inbox clutter for those less likely to be interested.

The Bank is implementing this model on an enterprise scale. By using predictive analytics, our client can target audience lists that can be constructed for any new research documents they produce.